POWER TRANSFER AT SAO MAI GROUP (ASM): WHAT TO EXPECT FROM THE 9X GENERATION HEIR?

Power Transfer at Sao Mai Group (ASM)

Last month, Mr. Lê Thanh Thuấn officially handed over the position of CEO to Mr. Lê Tuấn Anh. This is considered one of the significant leadership transitions for Sao Mai Group since its establishment in 1997, marking the transfer from the founding generation to the second generation of leadership.

This news is noteworthy for shareholders as Mr. Lê Thanh Thuấn has long been seen as the "soul" of Sao Mai Group. Over the 26 years since ASM’s founding, Mr. Thuấn has made a significant impact with his leadership. From a construction company, Sao Mai has evolved into a multi-sector enterprise with an impressive ecosystem.

In the early years, ASM seized opportunities to enter real estate and services. By 2003, the company transformed into a multi-sector group with a new focus on aquaculture, processing, and exporting seafood. A decade later, ASM expanded into the energy sector with a series of solar power projects in An Giang.

The new CEO of Sao Mai Group, born in 1994, is also Mr. Lê Thanh Thuấn’s son.

In addition, ASM has also made a number of other significant personnel changes. Specifically, at the 2023 Annual General Meeting of Shareholders of Sao Mai, it was unanimously approved to dismiss three members of the Board of Directors for the 2019-2024 term, including Ms. Le Thi Nguyet Thu - Chairwoman of the Board of Directors, Mr. Le Thanh Thuan, and Mr. Nguyen Van Phung - non-executive member of the Board of Directors.

Mrs. Lê Thị Nguyệt is Mr. Lê Thanh Thuấn's daughter. In March 2023, Mrs. Lê Thị Nguyệt Thu’s husband, Mr. Lê Nguyễn Hoàng Anh Duy, was appointed Deputy CEO of ASM.

The meeting elected Mr. Lê Văn Thành (born 1964) to replace Mrs. Lê Thị Nguyệt as Chairman of Sao Mai Group. Mr. Lê Văn Thành, Mr. Lê Thanh Thuấn’s younger brother, currently holds 973,846 ASM shares, equivalent to 0.29% of the capital.

Mr. Le Van Thanh has held the position of Deputy General Director of Sao Mai Group since January 1, 2017. In addition to working at ASM, Mr. Thanh also holds management positions at member companies of Sao Mai Group such as a member of the Board of Directors of Nhu Hong Joint Stock Company; a member of the Board of Directors of MIF International Finance and Communications Joint Stock Company.

According to ASM's shareholder structure, Le Thanh Thuan currently owns nearly 65 million shares, representing 19.31% of ASM's capital. The new General Director, Le Tuan Anh, holds nearly 38 million shares, representing 11.26% of ASM's capital.

Thuan and his family hold over 46% of the shares in Sao Mai Group.

Mr. Thuan and his family currently hold more than 46% of shares in Sao Mai Group.

Will Sao Mai's new CEO Le Tuan Anh create a miracle?

Immediately after the leadership transition, ASM’s stock saw impressive growth. Over the past week, ASM stock experienced five consecutive days of significant increases, with a 15.58% rise, including a limit-up session on June 8 with a trading volume of 13.2 million shares.

In the past month, ASM’s value increased by over 22.4%. Since May 1, 2023, the date of Mr. Lê Tuấn Anh’s appointment, ASM stock has risen by 30.99%. The average trading volume for this stock also reached over 5.6 million shares.

This indicates that whether under CEO Lê Tuấn Anh or Mr. Lê Thanh Thuấn, investors remain very interested in ASM.

However, leading a multi-sector conglomerate presents a significant challenge for a young leader like Mr. Lê Tuấn Anh.

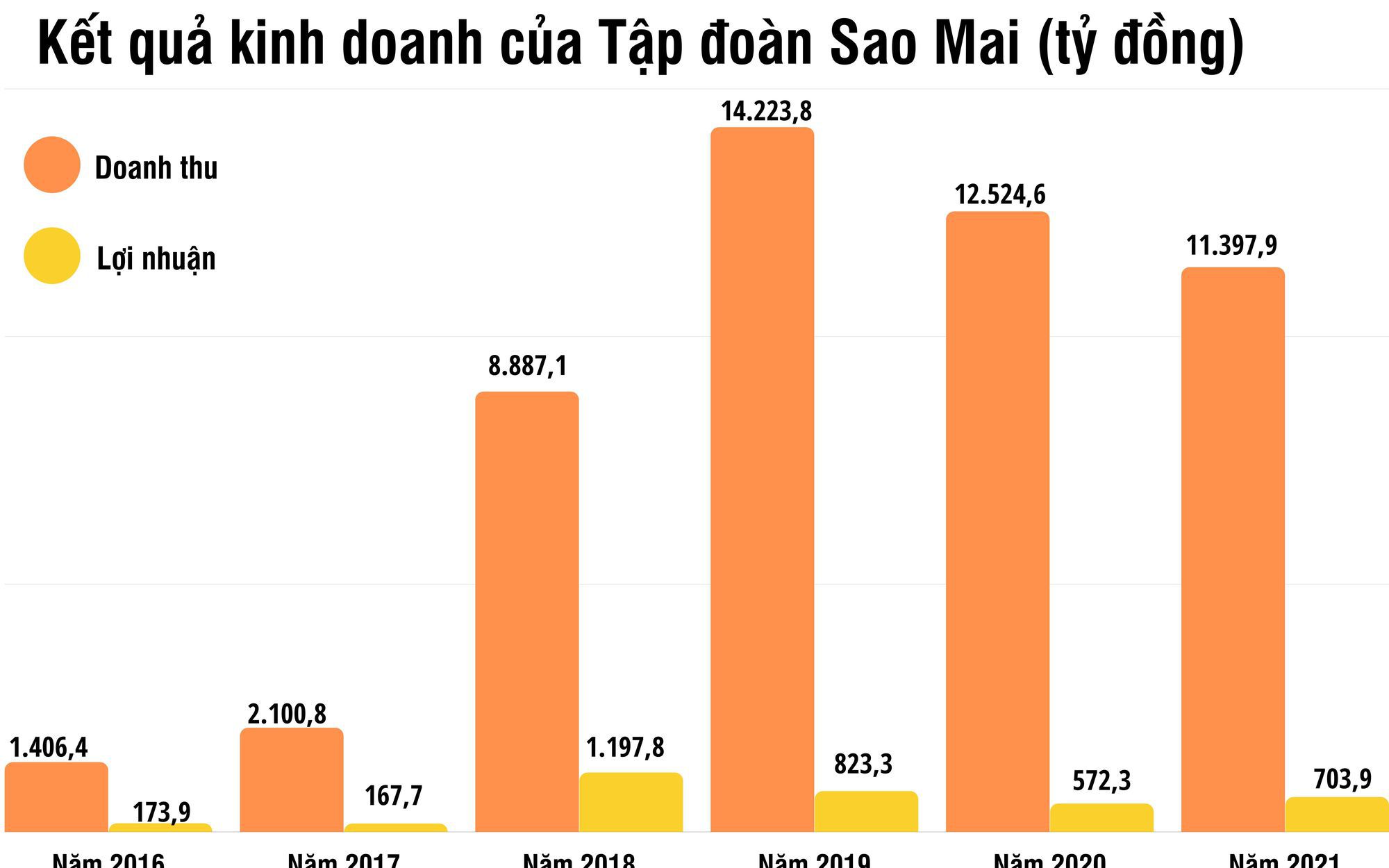

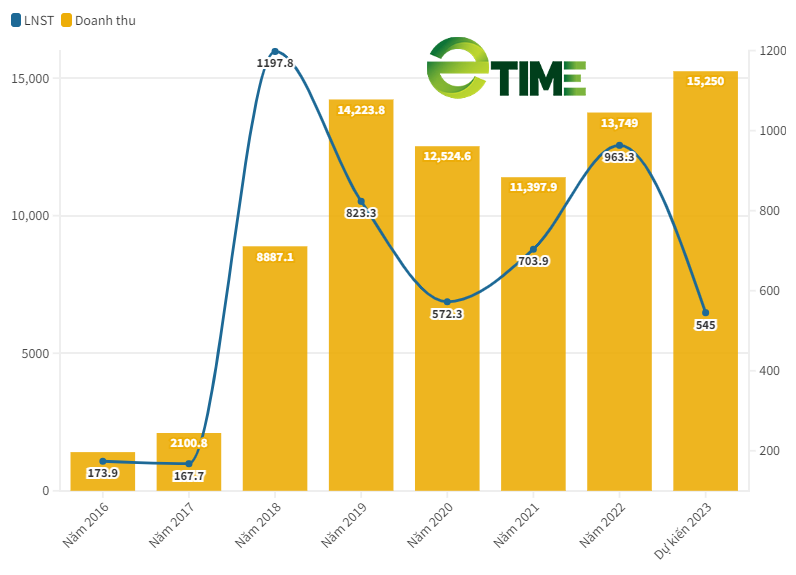

Business Results of Sao Mai Group Over the Years (in billion VND):

Data shows that during 2016-2017, Sao Mai Group's highest net revenue was just over 2,100 billion VND.

In 2018, the company’s business results saw a dramatic increase with revenue soaring to 8,887.1 billion VND and net profit reaching 1,197.8 billion VND, representing a 323% and 614% increase compared to 2017, respectively.

It is known that in 2018, Sao Mai Group invested in the Sao Mai Solar Power Plant with a total investment of 2,000 billion VND.

In 2019, the company's net revenue continued to grow impressively to 14,223.8 billion VND, up 60%, but profit decreased by 31.2% compared to the previous year.

In 2020, ASM's net revenue in 2020 decreased by 11.8% to 12,524.6 billion VND and profit decreased by 30.5% to 572.3 billion VND.

In 2021, although still affected by the pandemic, Sao Mai's business situation was quite bright. Net revenue decreased by 8% to 11,397.9 billion VND, but after-tax profit increased by 22.8% to 703.9 billion VND.

In 2022, ASM's net revenue reached 13,749 billion VND, and after-tax profit reached 963.3 billion VND, increasing 20% and 36%, respectively, compared to the previous year.

Overview of Le Tuan Anh's ecosystem.

Despite a generally positive business performance, from 2020, with the challenges of the COVID-19 pandemic, the growth rate of most companies has shown signs of slowing down. Sao Mai Group is no exception.

In the first three months of this year, ASM recorded a net revenue of 3,050 billion VND, a 4.9% decrease compared to the same period last year. Net profit was nearly 86 billion VND, a 73.5% drop, with the parent company’s profit reaching 69.2 billion VND, down 67% compared to the same period last year.

For 2023, Sao Mai plans to achieve a net revenue of 15,250 billion VND and a total net profit of 545 billion VND, a sharp decline of 43.4% compared to 2022.

For family businesses like ASM, breakthrough steps are crucial for survival and development if the right person is truly chosen. Many believe that the new leaders will face more demands than their predecessors. Therefore, to persuade and lead the entire organization, a leader must introduce innovative and creative directions and, more importantly, have the ability to execute them.

With these new challenges, can Mr. Lê Tuấn Anh create a significant transformation for Sao Mai Group?

danviet.vn